When trying to be responsible and save money for retirement, what do you usually hear from financial experts?

A caffeine aficionado who enjoys their calming morning routine with a quality espresso in hand hears: "Ditch the daily Starbucks, it's such a wasteful luxury."

Fashionistas who are inspired by styling outfits and wardrobes are advised: "Don't go shopping for new clothes, wear what you have."

And foodies who enjoys getting together with friends for a great meal hear: "You can save so much more if you just don't go out to eat."

Do any of these statements rub you the wrong way? Budgets shouldn't be about denial. They should be about empowered spending and realistic trade-offs.

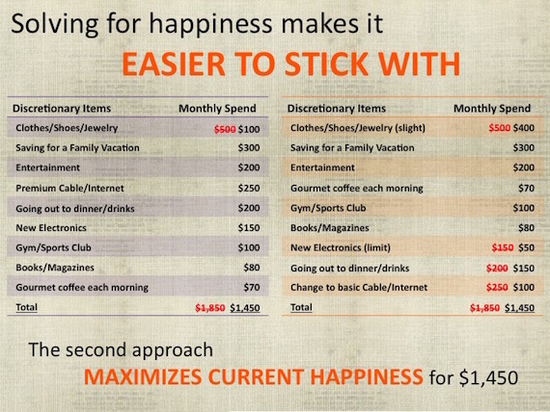

Traditional budget strategies instruct you to look at your discretionary spending, list items from most to least expensive and cut from the top of the list. So why does this oft-cited strategy fail so frequently? It neglects that make-or-break, all-important driver of success in any area of life - happiness.

What if spending money on lattes, clothes or fine dining makes you happy? Happiness is an important quotient to consider. Understanding how your brain works can make it easier to stick to good habits like saving. Careful, empowered spending can actually help, rather than hurt, your financial and emotional health.

Top-line items are easy targets, but cutting certain items without regard for the happiness they deliver can quickly sabotage a budget.

How to Happily Save for Retirement

What if you took a different approach and looked at ways to maximize happiness while minimizing spending? Here is a simple strategy you can try today that can help you set aside additional money for retirement or other long-term financial goals:

- Write down your top 10 nice-to-have's or nice-to-do's and their associated cost per month

- Now rank the list in order of which items give you the most happiness

- Cut the bottom three items

Prioritizing expenses by what makes you most happy to least and then cutting from the bottom of the list instead of the top can lead to a less frustrating budgeting experience and a healthier financial perspective. There will still be trade-offs and you will still need to prioritize. But in the long run, this approach to budgeting will likely be much easier to maintain.

It may take you a while to perfect this approach. For instance, expenses you thought were a source of happiness may turn out to be not the case, once you take out the items you think you don't value. The key is to keep tweaking until you find equilibrium. Eventually, this hyper-aware approach to trade-offs may help your current self sustain the financial stability of your future self.

So, put your current and future self on even footing and ask yourself, what would make me happy now and in the future? Think about it. Saving $400 per month for your future self could compound to over $2.5 million in 40 years.

Financial Mantras

Here are 10 mantras to keep in mind that will help you happily stick to a budget:

- Break down big goals into chunks

- Make it visual, write it down

- Reward effort, not just results

- Make it public, tell friends and family who will hold you accountable

- Make it tangible and celebrate small wins

- Do play-it-out visualization exercises

- Offer positive distractors when it gets difficult

- Allow yourself time to reflect on achievement to inspire further progress

- Avoid "all or nothing" thinking

- Don't test willpower to the point of exhaustion

As you settle on a budget that works and maximizes your happiness, be sure to balance your financial success with a pragmatic long-term investment strategy. Put aside just $10, $25 or even $100 each month in an investment account that will grow to fund long-term goals like travel and retirement. It's truly remarkable how your finances can take shape when your money has the longest time possible to grow. Financial freedom for your future self? Now that's happiness.

TD Ameritrade, Inc., member FINRA/SIPC. Stock investing is subject to risks, including risk of loss. Commentary provided for educational purposes only. Past performance of a security, strategy or index is no guarantee of future results or investment success.

Assumes $0 base, 10 percent annual interest rate compounded monthly, with $400 monthly deposit.