From monthly shoe-tying clinics that are booked solid months in advance to a fashion show that doubled as a school-supplies drive for local schools, the Shoe Train store in Potomac, Md., has fought head on against the challenge of shoppers who browse products in stores then buy them online from a rival.

Shoe Train owner Marina Fradlin doesn't sell children's shoes online, but she uses the Internet to combat showrooming. She connects frequently with customers online - answering common parent questions about shoe fit and promoting the shoe-tying clinics as well as community sponsorships of Girls on the Run events and shoe-collection drives.

She makes sure the website, social media and events tie into the store's natural business cycle (busy during back-to-school, slow in January/February, busy for spring shopping, etc.) and the calendar year. The goal is to make sure that when people are ready to buy, the ongoing relationship with the store and its employees makes a purchase at Shoe Train more likely.

The moves are paying off, she says. For example, the holiday season isn't typically a shoe store's busiest (back-to-school season is), but Fradlin looks for this year to be strong, based on where sales are now vs. previous years at this time.

"The holiday season definitely started earlier this year," she said, attributing part of the boost to Hanukkah falling so early this year. "It's already been a strong holiday season for us," she said by email, adding that UGG boots so far have been "a big gift item from Grandma."

Such efforts to create loyal customers and fight showrooming can be critical for retailers, especially as the U.S. economy continues to face growth headwinds. Wary of disappointing sales, major retailers including Wal-Mart Stores Inc. and Best Buy are discounting earlier than ever for the holiday shopping season.

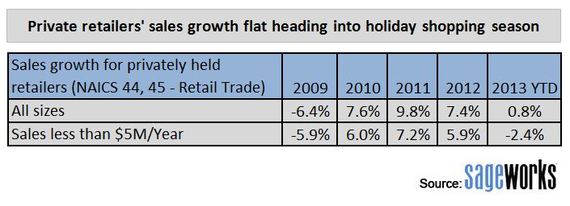

Recent retail industry data from Sageworks, a financial information company, show that sales growth among privately held retailers is virtually non-existent so far this year. Private retailers are growing sales at an annual rate of less than 1 percent year to date - the lowest annual rate since 2009. Smaller private retailers, those with less than $5 million a year in sales, are seeing sales contract at an annual rate of 2 percent so far this year, according to Sageworks' financial statement analysis.

Sageworks analyst Libby Bierman said consumers' apprehension about the economy couldn't have come at a worse time for private retailers. "These companies are sustaining rather than growing sales so far this year, and a holiday season boost would be tremendously helpful," she said. "These companies are showing slightly improved profit margins now, but if their rate of sales growth doesn't increase, these margins could be difficult to sustain, impacting retailers' hiring and investing practices in the future."

Sageworks' data doesn't break out how much of that sales rate is tied to in-store sales vs. e-commerce.

But it's clear that stores will need to fight in order to keep holiday sales, which can represent one-fifth or more of a retailer's annual sales, from being snatched away by online sites. The National Retail Federation expects the average person will complete nearly 40 percent of their holiday shopping online. And the NRF, which forecasts holiday sales growth of 3.9 percent, expects online retailers will post stronger growth than retailers overall.

Fradlin acknowledges she continues to encounter the challenge of shoppers who undervalue customer service and buy online. Nevertheless, she's optimistic for this holiday season as she believes customers in general are feeling better about buying. "There's a definite feeling of optimism in the air," she said.

In fact, her bigger concern this holiday season has to do with hot air. "Unlike for a lot retailers, where warmer weather brings a boost in sales, for me, warm weather keeps people away," she said. "My big seller during the holiday season is seasonal shoe-wear: fashion boots, hiking boots, UGGS. In other words, warm is bad."

Sageworks is a financial information company that provides financial analysis and industry benchmarking solutions to accounting firms.