Yesterday, the Congressional Budget Office released its updated budget projections for 2013 through 2023. The new projections reflect all developments since the CBO's last update in August, 2012. Unsurprisingly, the CBO's new base-case projections call for much higher ratios of debt to GDP over the next decade. These higher debt levels reflect the provisions of the American Taxpayer Relief Act of 2012, which is the agreement that averted the fiscal cliff at the start of the year. According to the CBO, the Act "made changes to tax and spending laws that will boost deficits by a total of $4.0 trillion (excluding debt service costs) between 2013 and 2022."

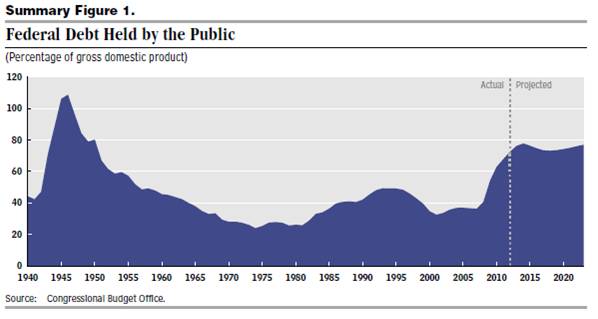

The chart below, taken directly from the CBO web site, shows historical debt levels relative to GDP along with the CBO's revised projections for the next decade. The first thing to note is that the ratio of debt to GDP is expected to fall modestly over the next few years as economic growth picks up and unemployment falls. However, things begin to change for the worse again after 2015. The CBO explains:

Deficits are projected to increase later in the coming decade, however, because of the pressures of an aging population, rising health care costs, an expansion of federal subsidies for health insurance, and growing interest payments on federal debt.

Moreover, the CBO's projection for a debt-to-GDP ratio of 77 percent by 2023 may be understated as this forecast assumes: 1) the automatic spending cuts commonly referred to as sequestration proceed as scheduled in March; 2) the sharp cuts in Medicare payment rates for physicians proceed as scheduled; and 3) temporary tax provisions designed to stimulate economic growth are allowed to expire as scheduled in 2013 and beyond. Under the assumption that none of the above actually happens (which may be more realistic), CBO estimates that debt would rise to 87 percent of GDP by 2023.

There is one final thing to note about out precarious budgetary outlook. The CBO's debt projections include only "Debt Held by the Public." The federal government's actual gross debt includes "intragovernmental holdings." This debt, which represents money that is owed to the Social Security trust and other federal programs, currently stands at a little less than $5 trillion. If we include this debt with the debt held by the public, the federal government currently owes over $16 trillion, which represents more than 100percent of our current GDP. Can anyone say Europe?

It should be crystal clear to everyone involved by now that we cannot solve the impending crisis without adjusting the promises we have made to future retirees. Social Security and Medicare, while excellent programs that have helped countless Americans sail into the sunset, are simply unaffordable in their current form. Whatever agreement Congress and the Obama administration dream up to avoid the debt ceiling and sequestration will not solve the long-term problem unless adjustments are made to these programs. These adjustments do not have to affect current retirees or even people scheduled to retire over the next 20 years. However, these programs must be adjusted such that the programs remain solvent and available, and so that our country's fiscal health improves. If the politicians could muster the political courage to get this done we would likely see a market rally that dwarfs the current one.