Did you catch it? The Fed didn't announce it but they have effectively cut the overnight lending rate by which banks loan money to each other by nearly 100 basis points. On Friday September 26th, the effective federal funds rate fell to 1.08%, making it the sixth straight day that the key overnight lending rate traded below the current official target level of 2%. While the financial community continues to worry about the horrors of deflation, the Federal Reserve is busily making sure that any such occurrence will be ephemeral in nature at best. It is true that real estate prices and equity values are falling. But that is a necessary outcome from collapsing asset bubbles. That does not mean that deflation has pervaded throughout the economy or that falling prices are here to stay. More importantly, the recent moves by the Fed and the Administration will ensure that the most salient problem facing our country's future will be inflation.

In the past week alone the Fed has injected an mindboggling amount of money into the banking system; $44 billion for the AIG (NYSE: AIG) bailout, $39 billion in borrowing from the discount window, $105 billion in Broker Dealer borrowing and $72 billion for the new Money Market Insurance program. Not only is the Fed busy debasing our currency but now we are close to passing the $700 billion bailout plan for banks, pension funds and credit unions. We Americans should be clear that the money we are loaning to banks is coming from ourselves. And since banks then need that money to make more loans to us we are effectively loaning this money to ourselves. As ridiculous as it sounds to loan money to yourself, it gets even more ridiculous when government officials claim that you will make money on your own investment. We all are aware that money loaned to government never gets paid back to the public. If any profit is made from this plan it will only be viewed by the government as an opportunity to increase spending.

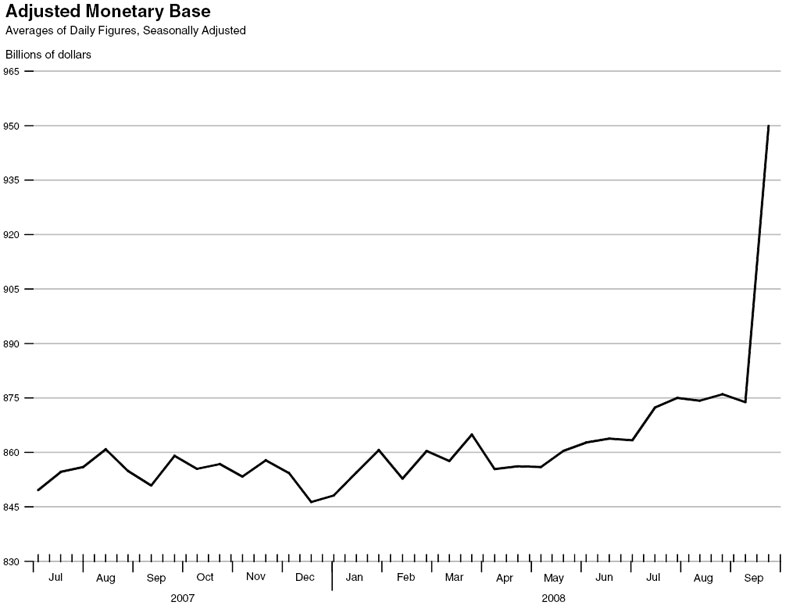

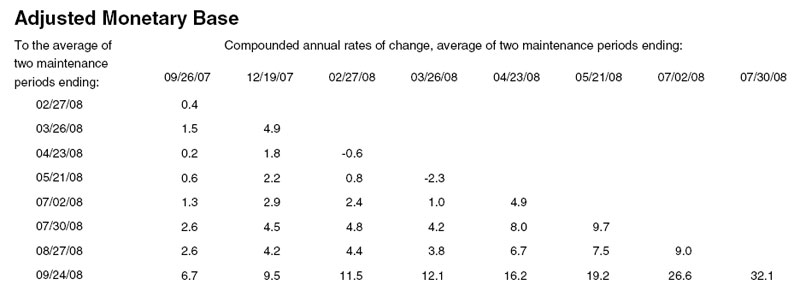

If you think that deflation is the main concern your thinking is very shortsighted. Take a look at the growth in the Monetary Base (high powered money). This is the only monetary aggregate the Fed directly controls and it consists of Commercial bank reserves held at the Fed + all physical currency.

As you can see from the above chart, the compounded annual rate of increase in the monetary base is 32.1%! it is important to remember that the base is used by banks to create credit and is the foundation of growth in the money supply.

Home prices remain elevated by most historical measures. But instead of allowing them to fall and suffering the consequences of our prior excess credit creation, we are rather sowing the seeds to an even greater inflation crisis in the future. Not only is the Central bank doing its best to inflate but as stated earlier, we now have the government amassing a mountain of debt that will require further monetization down the road. If this rescue plan proves inadequate, we can only look forward to another bill that will further increase debt, inflation and government incursions into the free market. In the end, the cycle of excess credit creation and debt which leads to unsustainable asset prices has to end. Those in power have yet to learn that it is impossible to avoid the consequences of an economy in need to deleverage. Unfortunately, they have deluded themselves to believe that they can solve the problems caused by inflation by inflating the problem away.