Phone Financing Programs Alter the Mobile Phone Marketplace

Consumer Intelligence Research Partners (CIRP) released results of its research on mobile phone financing plans. This analysis covers new phone activations from July-December 2013, roughly coinciding with the launch of AT&T Next, Verizon Edge, and Sprint One-Up plans, and T-Mobile's addition of the Jump plan. CIRP bases its findings on its survey of 1,000 US subjects that activated a new or used mobile phone in July-December 2013.

CIRP finds that these programs attracted almost one-third of customers that were eligible to participate. T-Mobile appears to have benefitted most, retaining a much higher percentage of customers than the other carriers, and attracting more customers from other carriers than they lost to other carriers.

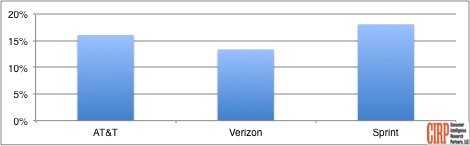

Participation at the major carriers varied from 13-18% of eligible customers (see chart). By definition, 100% of T-Mobile customers participate, since that carrier eliminated all phone subsidies, and only sells phones on a financing plan.

Led by T-Mobile, these financing programs now often resemble leasing, where customers pay monthly for a phone. So, customers either own the phone at the end of the lease term, or return it to the carrier and start paying for a new phone.

Including T-Mobile, 31% of eligible customers participated in a phone financing plan. 26% of all new phone buyers at the four largest carriers, and 23% of all new phone buyers at all US carriers participate. In the first six months since T-Mobile ended subsidies, and the other major carriers followed, a considerable number of eligible customers have embraced the concept. To be eligible at AT&T and Verizon, a customer must buy a new phone from the carrier's store or website, and at Sprint they must buy it from a Sprint store. Other retailers, like Best Buy, Target, Amazon, or even Apple Stores, currently do not offer these financing plans.

T-Mobile appears to have benefitted most from phone financing. They retained 98% of eligible customers - those that started the quarter with a T-Mobile phone and financed a new phone during the quarter. About two-thirds of similar AT&T and Verizon customers stayed with their carrier, and over 20% of AT&T and Verizon customers that financed a new phone switched to T-Mobile.

T-Mobile retained an incredible number of customers, with almost all T-Mobile customers that had a financing plan remaining with that carrier. T-Mobile also attracted a significant number of customers from AT&T and Verizon, rather than just from smaller regional and pre-paid carriers.

CIRP did not have a sufficient number of Sprint respondents to analyze the impact of phone financing on that carrier.

For additional information, please contact CIRP.