Whether we are talking about the perfect body or the perfect bottom line, a sustainable, new you is created through a healthy regimen that includes diet and exercise.

So... here are 11 ways to get fiscally fit once and for all, so that prosperity and abundance become your daily habit. This is far more effective than daily prayers that you win the lottery!

11-Step Action Plan for Fiscal Health

1. Lose weight. Are you carrying around extra expenses that are making your daily journey a grind? If you want to fly, you have to lighten your load. Cutting back on basic needs can launch you into the life of your dreams, whereas merely cutting out café lattes could just give you a headache! Make brave, wise and bold choices around the big-ticket expenses in your life -- housing, transportation, health insurance and taxes. Once you limit your basic needs to 50 percent of your income, you will have 50 percent to thrive on. If Warren Buffett can pay a 15 percent tax rate, so can the new, smarter you. How? Make financial literacy a priority in your life, so that you stop paying so much for housing, cars, taxes and health insurance and start compounding your own gains.

2. Eat healthier. Fiscal health is a result of daily smart meals and habits. Are you depositing the first 10 percent of your income into a tax protected retirement account (including 401K, Individual Retirement Account, Health Savings Account, etc.)? Did you know that if you start investing 10 percent when you are 18, you'll be a millionaire before you are 50 -- thanks to the power of compounding and returns -- even if you are only making $14 an hour and never get a raise! If you are just saving that money, you will never achieve financial freedom. And if you're just wasting your dough on cupcakes and stilettos, chances are you are in debt and getting in deeper with each passing day.

3. Play more. Health is wealth. You can't earn a great living if you can't get out of bed. Playing is great exercise, plus every smile comes with a splash of free endorphins -- the best antioxidant that money can't buy!

4. Trim the fat. Buy and Hold is last century's strategy. If you're still employing it, then you've made very little money in your nest egg over the past 14 years because every time the NASDAQ Composite Index or the Dow Jones Industrial Average drop by half (or more), it takes twice as long to crawl back to even. If you are not employing Modern Portfolio Theory and rebalancing your nest egg annually, it's time to learn how. This doesn't require more time or money. It requires wisdom and right action.

Performance of the NASDAQ Composite Index (in blue)

and the Dow Jones Industrial Average (in red)

January 1, 2000 - May 2, 2014

Source: Money.MSN.com. Used with permission from Microsoft.

5. Dream More. Invest in your dreams; don't drown in your basic needs, or numb yourself in the nonstop nightmare called the "nightly news," or waste the night in an obsessive/compulsive addiction to your social network. Space stations, the vaccination for polio and computers were all created by dreamers, not news junkies. So take tonight off for family vision boards.

6. Pass up the Get Out of Debt Free seminars and the fad diets. Debt is similar to dieting. When you adopt healthy fiscal habits, you're more likely to create wealth. When you try to pay down debt in one lump sum, you're more likely to balloon back up to serious debt fairly quickly because you are still chained to the unhealthy money habits that got you in debt in the first place. Adopt a thrive budget, pay yourself first religiously, learn how to compound your gains in a tax-protected retirement account and get smart about how the system is set up to make everyone else rich, so that you can create a different blueprint for yourself. This is not just about adopting a millionaire mindset. A new skill set -- based on wisdom and right action -- is necessary to employ the money strategies of the wealthy for personal financial freedom.

7. Date more. Commit to interviewing your business and financial partners as if your life depends upon it because your lifestyle does. Don't act as if you're lucky to have them take your business. Make sure that they earn the honor of being added to your team and that they are really qualified to give you expert advice.

8. Start Now With What You Already Have! If you can shop, you can pick stocks. If you tithe 10 percent to your own "buy my own island" plan and that earns a 10 percent annualized gain (what stocks and bonds have done for the past 30 years), you can become a millionaire. If you learn modern portfolio theory (don't worry, it's easy as a pie chart), you can profit in bull and bear markets. If you can pick a great life partner, then you can select the second most important person in your life -- your certified financial life partner. And if you didn't do such a good job with your partners and investments in the past, then wouldn't now be a great time to learn better strategies?

9. Whistle While You Work. When you add value, you prosper. When you add light to the room, you enjoy the smiles that glow in your wake as you walk by. Ask yourself, "What can I do for my customer? How can I make my company better?" Whether it is a company you work for or one that you own, you will find more money in your pocket from the increased customer satisfaction and sales, if you learn to show up and perform better.

10. Shop for a Promotion. If you want to get the job, you have to look as if you belong in that executive suite or boardroom. So invest in the wardrobe, but never pay retail for it. That's what sales (and those resale shops) are for... Do not use this as an excuse to go into debt as a shopaholic!

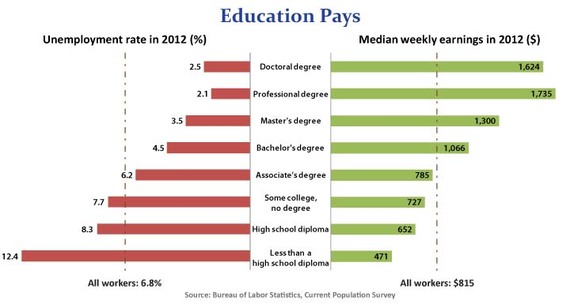

11. Educate Yourself. Education is the single highest correlating factor with income. Surgeons make more money than gardeners, and surgeons who have educated themselves about investing make greater gains than those who invest blindly (or not at all). So invest in your education -- from a qualified source. Be sure to grade your guru. It turns out that many of those "coaches," such as James Arthur Ray, are better showmen than shaman. If you haven't checked into the pedigree of your financial partner, she might not have a degree and could have been a rodeo rider last year. Someone who is qualified to teach you will have more than eight years in the business and a Ph.D. in results.