There are some very important events coming up during the first three months of 2014, which we all need to be alerted to.

Very Important Upcoming Calendar Events.

1. January 30, 2014. 4th quarter GDP growth

report (advance)

If the most recent projections turn out to be accurate, this report could be as low as 1 percent. Anything lower than this could shock investors.

2. March 21, 2014. Fitch reviews the U.S. Credit.

In previous correspondence, Fitch has said that they will "resolve" the negative credit watch up or down in the first quarter of 2014 (before March 31, 2014).

3. March 31, 2014. Fitch Action deadline.

Is the U.S. credit still AAA rated by Fitch Ratings? Or has Fitch removed the Credit Watch Negative?

Debt

The four-letter word in the economy today is debt. Debt lies at the heart of the Fitch Negative Credit Watch and pretty much every other challenge that is going on in the developed world today. There is a lot of misinformation out there, touted on official-looking webpages. So, as we contemplate how to fix this mess, it's important to know the real score on the major concerns of our Debt World, which are still in serious need of addressing.

10 Things to Know About the U.S. Economy and the Federal Debt.

1. The current U.S. public debt stands at $17.3 trillion. Current GDP is at $16.9 trillion, according to the Bureau of Economic Analysis.

2. The Debt Ceiling has been lifted through February 7, 2014. Some economists predict that the Treasury Department can move paper around to avoid the Debt Limit in February, get the income tax revenue in April and push out the next crisis until summer of 2014. This is not guaranteed, however.

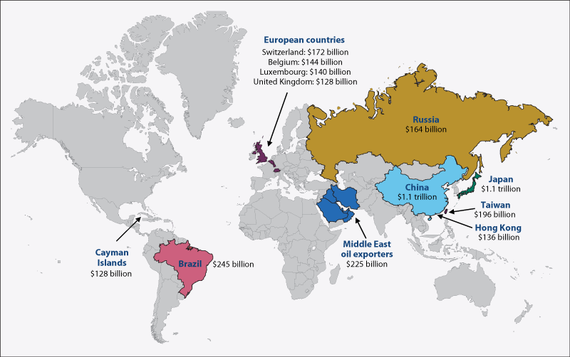

Foreign Holders of U.S. Public Debt

3. Foreigners hold about $5.6 trillion of our $17.3 trillion public debt - almost 1/3.

4. The top foreign holders of U.S. debt are China ($1.3 trillion), Japan ($1.2 trillion), Caribbean banking centers ($291 billion), Brazil ($247 billion), Oil exporters ($237 billion), Taiwan ($185 billion), Belgium ($180 billion), Switzerland ($174 billion), the United Kingdom ($158 billion) and Russia ($150 billion).

5. The U.S. dollar is still the most liquid currency in the world. 61.4 percent of global reserves (allocated) are held in US dollars (source: IMF). This is down from 72 percent in 1999. The Canadian and Australian dollars are now being measured. While this is a nascent currency movement, it is growing.

U.S. Credit Rating

6. Fitch Ratings currently has the United States on Negative Credit Watch. According to Fitch, the U.S. debt is double the median of other AAA countries. The debt level which Fitch believes is "no longer compatible with 'AAA'" is 110 percent for the U.S. We are very close to this ceiling, and there are other factors that contribute, including the global reserve status (a positive) and the credibility of our government representatives to corral spending and reduce the debt (uh... D-?).

7. What is the current debt to GDP ratio? Based upon the statistics above, it is 102 percent debt to GDP. However, Fitch might be calculating things differently, or including/excluding certain debt, or anticipating that the relationship might change in the next quarter or years to come. The downgrade is not a slam dunk. Stay tuned. The next Fitch review of the United States occurs on March 21, 2014, and the Credit Watch Negative should be resolved by March 31, 2014.

Personal Debt

8. Personal debt in the U.S. is $11.28 trillion (source: Federal Reserve Bank of New York). Mortgage debt is the largest piece of that, at $8.38 trillion, followed by student loan debt ($1.03 trillion) and $677 billion in credit card debt. Auto loans account for $902 billion of the debt.

The U.S. Budget

9. Historically, social security had surpluses, however, since 2010, the program has paid more in benefits than it received in taxes. This trend is expected to continue for the next 75 years.

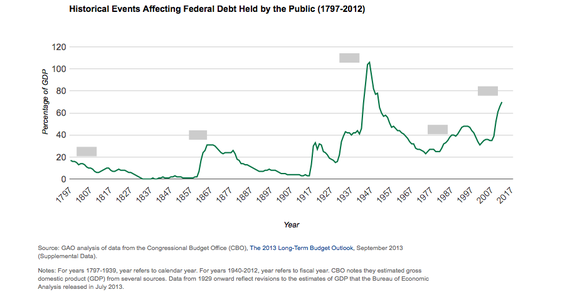

10. There is a very high correlation between war and high public debt. As you can see in the chart below, the public debt escalated during the Civil War, World War I, the Great Depression, World War II and in the wake of the Iraqi and Afghanistan Wars (and the Great Recession).

Sources:Treasury Dept., Government Accountability Office, The Federal Reserve, Fitch Ratings and The International Monetary Fund.