You don't have to have an offshore account to reduce your taxes! There are plenty of legal loopholes that you are probably not taking advantage of.

Here's the 5-point plan.

1.Pay Yourself Before Uncle Sam.

2.Pay Less to Uncle Sam.

3.Pay Less to Others.

4.Take More Write-offs.

5.Charity is the Best Networking.

And here are the details.

1.Pay Yourself Before Uncle Sam. Max out your 401K, IRA and Health Savings Account contributions. If you don't, you are not saving money. You are just paying more to Uncle Sam. Another added benefit is that your nest egg grows without capital gains tax. Other benefits are that your gains compound and your nest egg grows without capital gains taxes. If you deposit 10 percent of your income into a tax-protected retirement account and that earns a 10 percent gain (what stocks and bonds have done for the past 30 years), then you'll have more money than you earn in 7 years and your money makes more than you do in 25 years. This is your ticket to financial freedom! You can still contribute to your 2012 retirement accounts and take the tax write-off, so be sure to do that on or before April 15, 2013!

2.Pay Less to Uncle Sam. Rich folks, like Mitt Romney, are not "working" for a living. They are getting rich on passive income, i.e. their investments. Capital gains and dividends are taxed at 15 percent -- much lower than earned income. (The rate increased to 20 percent in 2013 for incomes over $450,000.) There are a few exceptions to this, such as short-term gains, coins and art, and real estate. So, learn Modern Portfolio Theory and get your money while you sleep flowing at a much lower tax rate than your daily bread!

3.Pay Less to Others. Most people have a lot of extra, unnecessary weight in their bills. If you are healthy, you can save a lot of money by getting a high deductible health insurance plan and opening a health savings account. You can dramatically reduce your energy costs by insulating your home, putting a timer on your water heater, purchasing energy-efficient appliances and powering your home with solar, geothermal and/or wind. You can shave hundreds of dollars off of your gasoline bill by riding a bike, carpooling and/or moving closer to work. The health savings accounts and energy efficiency upgrades are also tax deductible, reducing your payment to the IRS. The payback on solar panels, with the tax credits, is down to 4-7 years in sunny states, according to Michael Liebreich, the CEO of Bloomberg New Energy Finance.

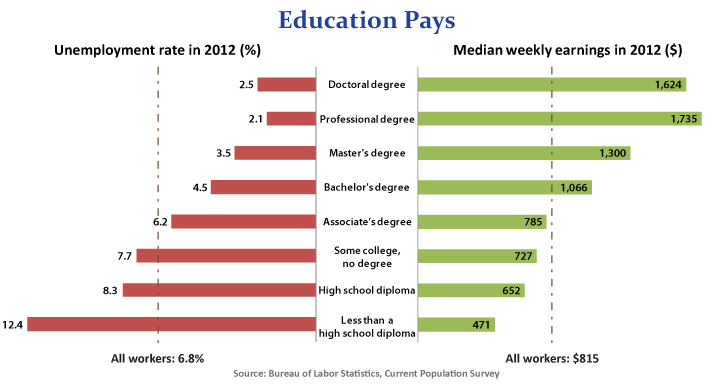

4.Take More Write-offs. Education is one of the most valuable assets, and it is also tax deductible. Americans with a professional degree or higher were employed in full force throughout the recession, experiencing only 2.5 percent unemployment, while those without any college education racked up over 12 percent unemployment. You'll make more money with a higher education as well, as you can see clearly in the chart below. Does your job require ongoing training, or would you be eligible for a raise and a promotion if you got a master's or Ph.D.? Take 10 minutes to discover whether you can claim the American Opportunity Credit, the Lifetime Learning Credit or the Tuition and Fees deduction.

5.Charity is the Best Networking and it's tax deductible. Mitt Romney had the Mormon vote locked up during his run for president in 2012. He's been tithing to the church for his entire life, and serving in its leadership since he's been an adult. Give your time, talent and money to the charity or church that you most love and you will find your people. A community of your people can create great things together, and they will be the first to support you in any endeavor. Including your run for President. So, rather than spread small gifts across multiple charities, or not giving to charity at all, but giving a lot more to Uncle Sam, give 10 percent to your favorite charity and take the tax write-off. Another added benefit is that if you are in a leadership position, you can be assured that the money is well spent on the constituents it claims to serve.

While this isn't a complete list of all of the ways that you can reduce your tax bill, these five items are the most commonly overlooked ways that you can keep more of your own money. Make your bill to Uncle Sam smaller, while increasing your assets and beautifying your bottom line now, and you will be in a position to live a richer life today and into the golden years.

Beware of "tax havens" and websites that promote them. Cyprus was one of the most popular tax shelters in the world -- even into 2012.

Congress extended the energy efficiency tax credits into 2013 with the American Taxpayer Relief Act of 2012.