For the past year there have been worries that the FHA might require taxpayer money to pay off lender claims for loans gone bad. But now it may be that the economy has turned around and the FHA may well do better than anyone thinks.

Why is this important? It could lead to lower FHA insurance costs.

To understand what's happening, let's begin with the FHA and what it does: The FHA is an insurance plan started in the 1930s to increase home ownership in the U.S. The FHA does not make mortgages; it insures them. With FHA insurance, buyers can purchase real estate with just 3.5 percent down because lenders believe that the FHA will cover any losses they face if the loan is foreclosed.

Because the FHA is an insurance plan, it follows that those who use the program must pay premiums. With the FHA there are two forms of premiums:

First, there is an up-front mortgage insurance premium (up-front MIP) which is equal to one percent of the loan amount.

Second, there is an annual mortgage insurance premium (annual MIP) which, for most borrowers, is equal to 1.35 percent of the loan amount for most borrowers.

The premium money is placed in a reserve fund and used to pay off lender claims when properties are foreclosed.

A Good System Gone Bad?

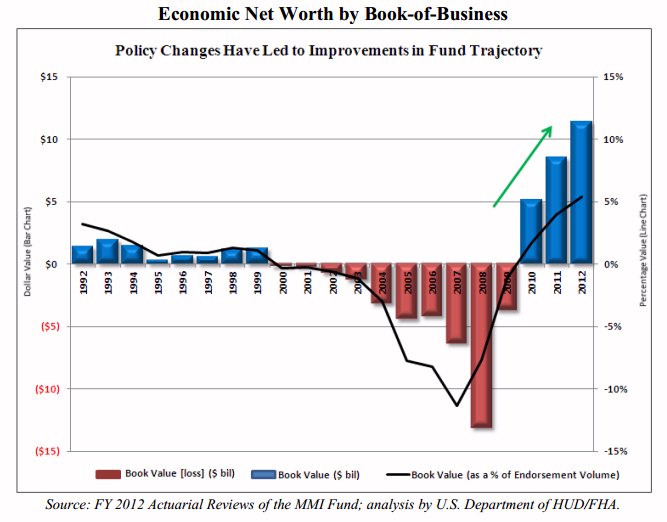

The fly in the ointment is that HUD projections suggest that the reserve fund could have losses of up to $16.3 billion, and might have to borrow from the Treasury for the first time since the FHA loan program was started in the 1930s. These possible losses have compelled the agency to increase the cost of its insurance several times in the last few years.

But now it seems likely that actual losses will be far smaller and perhaps there will be no losses at all.

How is this possible?

Three reasons.

A Good System Still Good

First, the FHA is not losing money on loans made since 2009; it is losing money on housing-bubble mortgages made between 2000 and 2008. As time goes by there are simply fewer such older loans and thus fewer mortgages from that period to go bad.

Second, HUD increased FHA mortgage insurance premiums earlier this year, meaning more money is coming into the system from each new loan.

Third, many housing markets are recovering and with the improvement there will simply be fewer claims and the claims which are made will tend to be smaller because of rising home prices.

Consider Fannie Mae and Freddie Mac. They insure mortgages sold to investors. According to the Washington Post, "over the past year, however, Fan and Fred have enjoyed a remarkable turnaround, thanks to an improving housing market and the fact they are now financing and refinancing virtually every mortgage in the country, with a higher profit margin on each loan than at any time in their history. As a result, the two companies last year had a combined profit of $28 billion, their highest ever."

If the market is improving for Fannie Mae and Freddie Mac then by definition it must also be improving for the FHA program.

Lower Premiums for New FHA Loans?

The result is that the FHA may be doing much better than earlier estimates suggest. The FHA might actually be in a position to lower mortgage insurance premiums for new loans, something that would increase home affordability for millions of potential borrowers -- if Congress will allow reduced FHA premiums.