Big banks are spending millions of dollars to lobby congress against passing new consumer protections. At the same time, they're devising new fees to minimize the impact of these new regulations. They might win some of these battles and figure out how to protect their fee revenue in the short-term, but they're losing the war for customers. Eventually, customer-attrition will force them to change or perish.

Recently, FindABetterBank teamed up with the popular personal finance blog "I Will Teach You To Be Rich" to survey the blog's readers about their feelings toward their primary banks. The blog's readers are mostly tech-savvy consumers under 30 who care about personal finance matters. We had over 1,400 US-based responses and the results indicate that big and regional banks' real problem is not the threat of new consumer protections, but their angry customers.

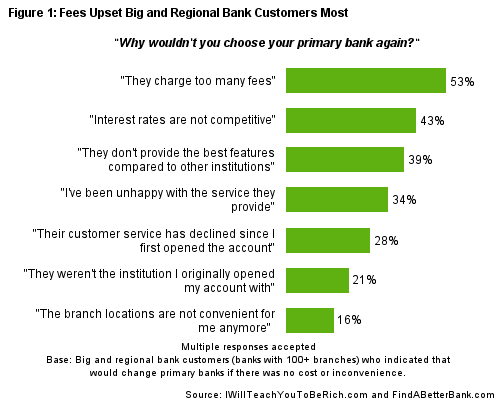

- Over 35% would switch if there was no cost or inconvenience. It's really hard to grow your customer base when you have so many disgruntled customers (community banks, credit unions and online banks don't have nearly as many unhappy customers). Why are big and regional bank's customers so upset? More than half indicated it's because of fees (See Figure 1).

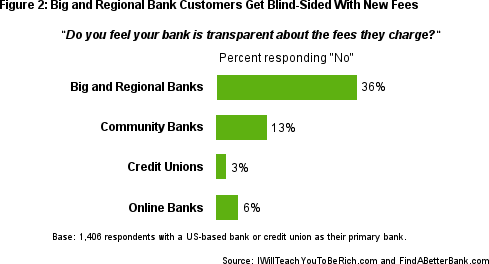

- 36% feel big and regional banks aren't transparent about fees. Sure, banks are by law required to disclose fees, but they do it ways to ensure we don't notice. So while they're not violating any laws, their sneakiness leaves a bad taste with customers that will come back to haunt them (See Figure 2).

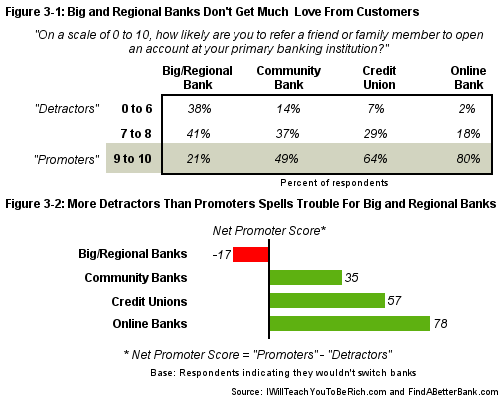

- Credit unions, community banks and online banks are cleaning their clocks. We asked those that would continue to do business with their current bank or credit union whether they would recommend the institution to a family member or friend. You guessed it... very few people would recommend their big bank (See Figure 3-1 and 3-2). And we didn't even ask people who want to switch this question - the story would be even worse. Note: For market research buffs, this is the "Net Promoter" question.

- Large branch networks are less important to younger consumers. Only 24% of respondents under 30 visit a bank branch 1 or more times a month. But over 40% of respondents 40 or older use a bank branch at least that much. Future customers won't have these old habits and will be more comfortable using technology instead of a teller.

If you're upset with your bank:

– Visit FindABetterBank

– Join "Move Your Money"

– Join my Facebook group "1,000,000 people who hate their bank"

Here's some great advice from my colleague Ramit Sethi of I Will Teach You To Be Rich:

– Negotiate with your bank to get them to remove fees;

– Learn how to automate your personal finances.

If you're a member of Congress, tell the banks to stop bugging you and start worrying about their customers.