For the past 25 years, I have been hearing how corporate social responsibility (CSR) and sustainability will be critical for the corporate world on three levels:

- Finance

- Personnel

- Reputation

You can't find a leading ranked MBA program of business school that is not teaching social enterprise, impact investing or sustainability. Instead, Harvard Business School, Yale University's School of Management, The Wharton School of the University of Pennsylvania, Kellogg School of Management, The University of Chicago Booth School of Business, NYU Stern, Saïd Business School - University of Oxford, Stanford Graduate School of Business, Haas School of Business-Universtiy of California-Berkeley, Columbia Business School, Hult International Business School, Duke - The

Fuqua School of Business, University of Michigan Ross School of Business, Rotman School of Management-Univesrsity of Toronto, Schulich School of Business, Samuel Curtis Johnson Graduate School of Management-Cornell, and many others. There are even lists of the best business schools for social enterprises. Business plan competitions have sprung up, like Hult Prize, which offers $1 million dollars for the best social enterprise plan. Morgan Stanley partners with Kellogg and Insead for the Morgan Stanley Sustainable Investing Challenge.

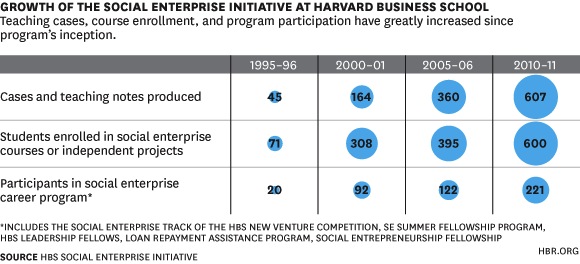

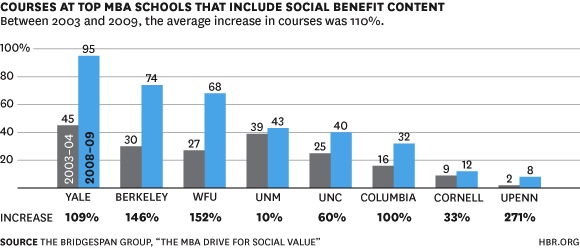

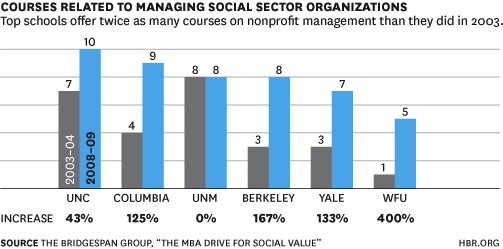

Here is a study on universities teaching social enterprise.

When I visited Wharton, I was told that the most popular club at the business school was social enterprise. Other universities echoed those thoughts. It is with that in mind that TBLI has engaged in academic partnerships with the leading business schools to host TBLI as part of educational outreach to students, faculty and alumni. Those schools include INSEAD, The Wharton School of the University of Pennsylvania, NYU Stern, BI Norwegian Business School, Copenhagen Business School, Hult International Business School, Free University Amsterdam, Kellogg School of Management, and The University of Chicago Booth School of Business.

Recruitment Opportunity

With all this supply and demand by students, why aren't the recruiters of the leading corporations and financial institutions positioning themselves as impact investing or social enterprises advocates or supporters? This is a golden opportunity with so many students wanting to either start their own social enterprises or work for companies that support these initiatives.

If student and alumni interest continues to grow, demands on the financial sector (wealth managers, investment banks, asset managers, service providers) and non-financial sector will become equally large. Responding too slow and too late could impact recruitment, client retention and new clients. Seize the opportunity and show the best and the brightest why working for your organization can achieve both career and fulfillment goals.

For the past twenty years, Robert Rubinstein, through the TBLI Group, has been instrumental in integrating Values Based Investing (VBI) into the culture and strategy of international corporate business and investment companies.