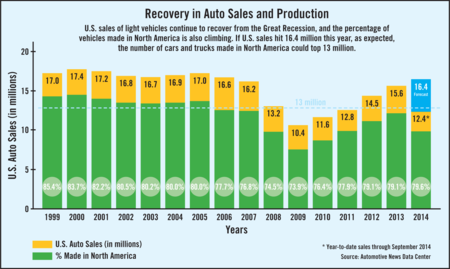

If the U.S. automotive industry hits popular forecasts of 16.4 million car and truck sales this year, it is likely that the number of vehicles built in North America will surpass 13 million in 2014 - for the first time in nearly a decade.

IHS Automotive, among others, estimates that US auto sales will hit a robust 16.4 million cars and trucks this year, up from the depressing low of 10.4 million in 2009 during the Great Recession.

But it's not just sales that have been gaining. The percentage of those vehicles that are also built in the US, Canada and Mexico has also been climbing since 2009, too, according to data from the Automotive News Data Center. The gain has been driven by the sales recovery of the Detroit Three automakers, as well as foreign car makers, who make many models in North America now.

In the decade between 1999 and 2009, the percentage of vehicles purchased in the US that were also made in North America had declined, from 85.4 percent to 73.9 percent of total sales, data from Automotive News shows. That 11.5 point drop represented a production loss of 6.8 million cars and trucks - and it forced automakers to shutter factories and lay off tens of thousands of workers.

By the end of 2009, just 7.7 million of the cars and trucks sold in the US were actually made in North America. That is about half of what it had been a decade earlier.

Since 2009, however, the needle has been moving in the other direction.

During the past four years, US auto sales have grown by 5.2 million cars and trucks, and the number of US-purchased vehicles that were also made in North America has grown by 4.6 million cars and trucks, Automotive News' data shows.

So far this year, 79.6 percent of the cars and trucks purchased in the US were made in North America.

Historically through 2012, most North American production, more than 85 percent, has remained in the United States, according to data from WardsAuto.com.

If the automotive industry hits IHS' forecast of 17.4 million car and truck sales in 2017, that could translate into more than 13.8 million cars and trucks manufactured in North America. And that's if the share of vehicles made in North America remains constant, when, in actuality, it's been increasing.

The increase in North American automotive manufacturing has strengthened the network of manufacturers -- many of whom are small machine shops that make tooling and other parts for larger suppliers and automakers -- all the way from Ontario and Detroit to Mexico City.

Foreign and domestic makers of machine tools and other manufacturing technology have been bullish about the recovery in the automotive sector, and it's not just the growing manufacturing volumes that are causing excitement either.

As you can see in Manufacturing Engineering's annual Motorized Vehicle Yearbook - which is released in November and available for free in our digital edition -- tougher federal regulations on fuel economy and emissions are driving a total rethinking about the way cars and trucks are designed and manufactured. Innovations in materials and new approaches to make lighter, more efficient engines just scratch the surface of the new high-tech approaches to designing and building the cars of the future.

The changes are driving new investments in manufacturing technologies at the same time volumes are climbing.

Recently, I was out at Heller Machine Tool's North American headquarters in Troy, MI, where I was taking a closer look at their innovative Cylinder Bore Coating (CBC) technology, which is a groundbreaking technique that can take weight out of automotive engines and make them more efficient by reducing friction in the cylinder.

Of all the markets in which the German company does business around the world, the American market is increasingly looking like the sweet spot these days, Keith Vandenkieboom, President and CEO of Heller Machine Tools told me. The US auto industry, he said, is a major reason for that.

This column originally appeared on www.AdvancedManufacturing.org.

Our 2024 Coverage Needs You

It's Another Trump-Biden Showdown — And We Need Your Help

The Future Of Democracy Is At Stake

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

The 2024 election is heating up, and women's rights, health care, voting rights, and the very future of democracy are all at stake. Donald Trump will face Joe Biden in the most consequential vote of our time. And HuffPost will be there, covering every twist and turn. America's future hangs in the balance. Would you consider contributing to support our journalism and keep it free for all during this critical season?

HuffPost believes news should be accessible to everyone, regardless of their ability to pay for it. We rely on readers like you to help fund our work. Any contribution you can make — even as little as $2 — goes directly toward supporting the impactful journalism that we will continue to produce this year. Thank you for being part of our story.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

It's official: Donald Trump will face Joe Biden this fall in the presidential election. As we face the most consequential presidential election of our time, HuffPost is committed to bringing you up-to-date, accurate news about the 2024 race. While other outlets have retreated behind paywalls, you can trust our news will stay free.

But we can't do it without your help. Reader funding is one of the key ways we support our newsroom. Would you consider making a donation to help fund our news during this critical time? Your contributions are vital to supporting a free press.

Contribute as little as $2 to keep our journalism free and accessible to all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you'll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.