With increased strategic comprehension, designers understand and manage market and technology risk better as well as display fewer day-to-day intuition biases. However, increased strategic comprehension also seems to change their judgment of reality, giving rise to a false sense that they can predict and control their strategic environment.

Designers need knowledge, skills, experience and a certain measure of confidence to turn a business idea into a viable concept. However, there is a fine line between confidence and overconfidence and when that line is crossed, design may well turn from an investment into a gamble. This may be good as long as there is an understanding of the difference between the two and when one or the other is required.

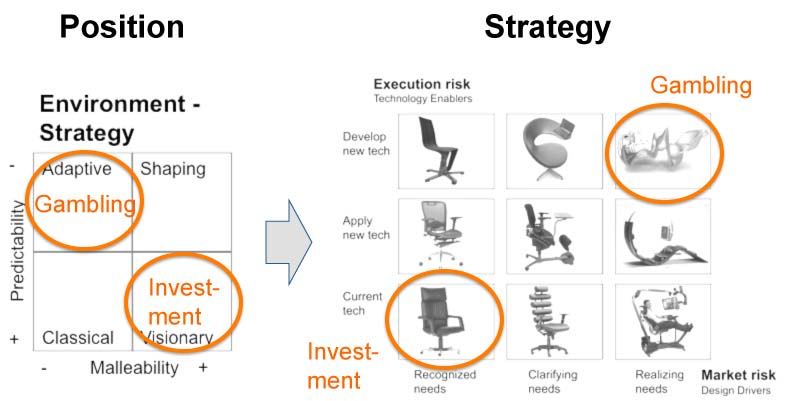

Gambling can be defined as wagering on an event with an uncertain outcome and having no control over the outcome; while investment is allocating resources towards an endeavor with known probability and control over the outcome. In reality, these are two extremes on a dual risk-scale from low to high probability and low to high control, where the first corresponds to what is going on in breakthrough innovation and the latter in incremental innovation.

Studies at Stanford University show that when designers are briefed on the overall strategy, their performance increases. Even better, studies from Hanyang University show that when designers participate in the formulation of the business opportunity, they gain insights into the various parameters and their tradeoffs. This enables design to tackle the inevitable changes though the design process and in the end, design performance goes up.

The downside of strategic comprehension is that it can make one believe that one is more in control than is actually warranted, especially when the strategic comprehension is incomplete. The Hanyang University studies show that as designers co-create business strategies, business models and design briefs their increase in understanding makes them believe they can control and predict the strategic environment. Their participation in the business process reduces their feeling of ambiguity, which, again, causes them to take on more risk.

This tendency to overestimate control combined with an inverse relationship between strategic comprehension and risk taking makes designers with incomplete strategic comprehension 'risk seeking gamblers' and designers with comprehensive strategic comprehension 'careful risk adverse investors.'

This is just the reality of human beings and is neither good nor bad, with the opportunity being to leverage this knowledge into a competitive advantage. For a balanced portfolio, one needs both incremental and breakthrough innovations and, by nature, these are linked to the attitudes of gambling and investments.

A pure gambling situation corresponds to an Adaptive Environmental Strategy (low malleability, low predictability) while a pure investment situation corresponds to a Visionary Environment Strategy (high malleability, high predictability). The mixed strategies correspond to Classic (low malleability, high predictability) and Shaping (high malleability, low predictability).

So, there is a balancing act between the building of internal capabilities in understanding and controlling the market and the technology, then leveraging this in the design effort while nudging the design team to take on the appropriate risk strategy. For breakthrough innovation, that will be encouraging designers to act more like gamblers, while insuring the gambling stops when the budget runs out and that losses are embraced as sunk cost. The challenge is to recognize which environment one is in and then to apply the right strategy with its associated risk.