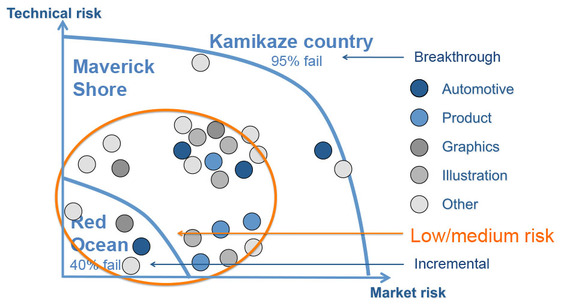

Designers seem keenly aware when taking on technology risk, however, they can be completely blindsided by the equally detrimental market risk. Possibly because the majority of the challenges designers are exposed to are incremental projects that result in designers being inexperienced and relatively insensitive to market risk. Or, perhaps the technology-risk is simply more "in their face" during the everyday execution of the development process -- since prototypes have to work.

We all live with risk and there is nothing inherently good or bad about it, as long as we are aware of the risk and can assess the associated probabilities of cost. However, when we move away from the relatively known incremental innovation with a thirty to forty percent risk of failure, and into the unknown realm of breakthrough innovation, with a ninety-five percent risk of failure, we effectively cross over from the laws of investment to the laws of betting.

When under the jurisdiction of investment laws, one calculates and constructs a diverse portfolio of independent investments. However, under the jurisdiction of betting laws, one applies a shotgun approach with small limited bets in the magnitude of 0.5 to one percent of one's capital. The ratio between investing and betting should be one to twenty.

So how does this work in practice? Studies of creatives with an average of four and a half years of design experience at a world-class design college, showed all majors to be equally risk-averse. We also found a linear relationship between perceived risk-taking in general and the perceived technology risk they undertook. While we found no such relationship between perceived risk-taking in general and perceived risk-taking in market position. Thus, a creative's perception of risk-taking is strongly skewed and they are thus unaware of what the market demands.

A similar study was done with marketing students at a leading business school that also revealed risk-aversion. Here, the perceived risk-taking and market or technology risk showed no relationship at all. Risk perception and risk and actual risk behavior are thus completely divorced.

These studies show that despite the widespread adoption of user-centered design, this has not been translated into considerations about whether the target users are actually willing to purchase the need-solutions they have so carefully divulged.

Studies of managers and marketing professionals show that the more empathetic these individuals are, the more they believe their personal preferences reflect those of the users. Methods such as Design Thinking, which rely on user-centered design, may therefore contain a concealed bias towards the user-researchers' preferences and inadvertently and unknowingly introduce a high level of market risk when applied.

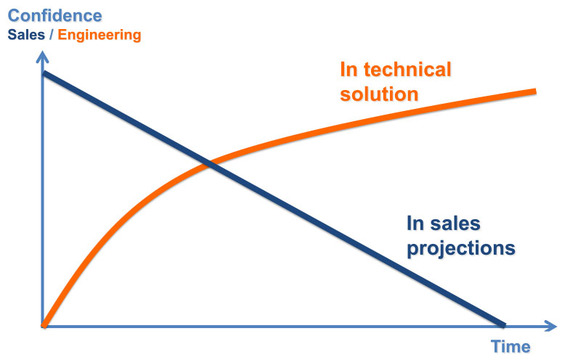

Of course perception of risk and confidence in one's predictions evolve over the course of a product development project. As time passes, design and engineering become increasingly confident that their design works. In stark contrast, marketing's confidence in their initial rosy predictions fades and they will not really know how accurate their estimate was until the offering is available in the stores.

Why then make rosy market predictions in the first place? The answer is that it is all part of the game. If a project's market predictions do not display exponential hockey stick growth in sales and revenues, the project will be dismissed and if one cannot identify and propose opportunities with these levels of profit, one is not worth one's keep. Thus overselling and over-betting takes place to delay the inevitable outcome - until one runs out of luck.

What can creatives do to alleviate this situation? If they remain blind to market risk, they will continue to be blamed for producing designs that users won't buy, but for which they may have actually asked. One option for creatives to avoid this moral hazard is by taking on the responsibility for designing sellable offerings and by continually demanding market assumptions be challenged and tested as part of their design progress. Risk doesn't care if it is technical or market related and the probabilities have no understanding about one's blindness concerning either one. When all is said and done, it is still better to know than not to know.