In the world of personal finance, where consumers constantly are forced to make decisions about daily cash-flow and paying bills, the availability of up-to-date reliable financial information is critical. The more consumers know about their current financial situation, the better decisions they can make on current and future spending. Without real-time information, consumers walk blind and can suffer severe consequences. Imagine making spending decisions based on a two-month old bank statement. Obviously, this does not make much sense in an age where access to bank balances, upcoming bills and credit card transactions are a few taps away on your smartphone.

Similarly, but on a much larger scale, economists struggle to provide government and central bank policy makers with up-to-date consumer trends (income and spending patterns), which could lead to poor decision making in areas such as monetary and fiscal policy (interest rates and economic stimulus). With access to real-time consumer economic data, the federal government and the central bank can make quicker and better decisions to best stimulate the economy out of a down-turn or overheated market. Unfortunately, most policy decisions are based on lagged consumer trends, that don't always reflect the current circumstances of U.S. consumers.

In an effort to gain a deeper and more current understanding of how consumers are doing financially in areas of consumption, income, and keeping up with their financial obligations, Pageonce teamed up with a distinguished team of economists from the University of California Berkeley and the University of Michigan to gain further insight. The team aims to explore how economists and policymakers can use real-time economic data for better decision-making. Allowing for a 360-degree perspective on hundreds of thousands of anonymous U.S. consumers offers a wealth of insight into the financial habits of Americans at large. The research project is set to produce and publish a number of real-time, highly accurate indices measuring current income, consumption, and financial distress among an exceptionally large sample of consumers.

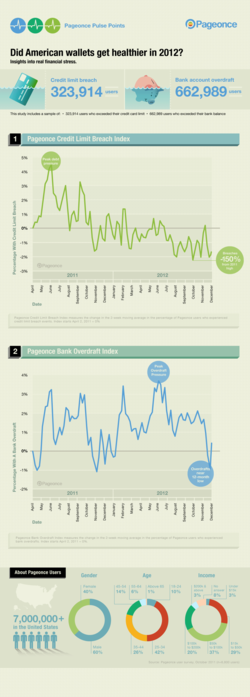

Given the interest and focus on economic distress in recent years, the initial set of indices produced by the Pageonce economics team covered trends in credit limit breaches and bank overdraft occurrences among Pageonce users. With data collected since April 2011, the indices are established historically and continue to evolve as new data is collected on a daily basis. As a good sign for the US economy, the most recent data from the study shows that U.S. consumers are continuing to slowly, but steadily reduce their financial distress.

December 2012 Report: Economists' Observation and Commentary

In this latest report we look at the level of credit card limit breaches among users and at their level of bank overdrafts. Both of these indices show downward trends since the beginning of June 2012, reversing what had been an upward climb that began at the end of 2011.

The credit card limit breach index reflects the percentage of users who exceeded the limit on at least one of their credit cards [Graph 1]. This index has fluctuated at the end of 2012, but the overall trend reflects a slow decline. The bank overdraft index captures the percentage of users who went into overdraft status on at least one of their bank accounts. Here we see more dramatic declines since a peak in June. The index is now near its 12-month low [Graph 2].

Do these declines in financial distress simply reflect the season? Do consumers always get their financial house in order just before the winter holidays, or is the relief from distress a sign that the American consumer is building strength to last? Comparing these indices to their levels a year ago, the trends look more like real strength than simple seasonal fluctuations. The credit limit breach numbers are clearly more positive this fall and winter then they were at the same time a year ago, and even the overdraft index is tending toward a year-on-year improvement. This is in line with several signs of steady progress in the U.S. jobs outlook and in the housing market including the National Association of Home Builders/Wells Fargo Housing Market Index showing eight consecutive months of gains.

Overall this latest report lends further support to the idea that U.S. consumers are on a firmer financial path as they head into 2013.

Pageonce provided the University of California, Berkeley and University of Michigan, Ann Arbor researchers a sample of anonymous user data from April 2, 2011 to December 01, 2012. This data set includes 323,914 unique Pageonce users who experienced at least one Credit Limit Breach Pulse Point and 662,989 unique Pageonce users who experienced at least one Bank Overdraft Pulse Point from September 01, 2012 to December 01, 2012. Each unique Pageonce user in the population was assigned a value of one (1) if the user experienced a Pulse Point. Otherwise the user received a value of zero (0). For each of the 88 weeks in the data set, the fraction of users who received a Pulse Point was recorded. To account for increases in the Pageonce user base over time, the raw fraction of users that received a Pulse Point was weighted by the total number of Pageonce users.