A few of Wall Street's bizarre and enduring myths:

- Those you invest with are looking out for you;

- High risks will yield high returns; and

- Anyone can do this.

As professional money managers, we want to debunk widespread, commonly held, yet wrong beliefs for you to make more informed decisions as your wealth increases. Below is our first "true or false" quiz.

True or False: Of the million or more registered financial advisers in the U.S., less than 1 percent act in a fiduciary capacity, 100 percent of the time.

TRUE. What does it mean, exactly, to be a fiduciary and why is this so important? In Latin, fiducia, means "trust." The fiduciary is a person, persons, or business with the power and obligation to act for another under circumstances which require total trust, good faith and honesty. He or she is held to a standard of conduct and trust and must avoid self-dealing or conflicts of interests in which the potential benefit to the fiduciary is in conflict with what is best for the person who trusts.

According to a recent Financial Advisory Survey done by the National Association of Professional Financial Advisors (NAPFA), there are less than 2,500 representatives nationally who are designated fiduciaries. So less than 1/2 of 1 percen of the over 1 million Registered Securities Representatives are held to the fiduciary standard. If less than 1 percent of all advisers are legally obligated to hold your interests above their own, do you feel confident that your financial advisers are looking out for you? Despite savvy media campaigns, clearly there are registered advisers who put their own needs ahead of their clients'. Do the people who are handling your assets fit this description?

True or False: High risk yields high returns on investments.

FALSE. If high risk investments yielded high returns, it would not be high risk! High risk means that the returns are highly uncertain. You may get a high return, or, you may get a big loss. Or, you may lose everything. Low risk investments have a highly certain return. The real question should be: what types of returns are most likely to help me achieve my goals?

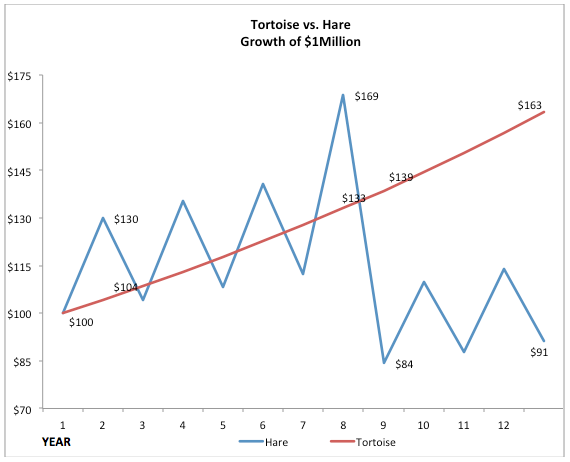

The story of "The Tortoise and the Hare" illustrates the power of compounding incredibly well. Volatile, inconsistent performance (think of the hare) can take investments up 30 percent, then down 20 percent and back again in a roller coaster cycle. There are two key elements to remember. 1) Every time you lose 50 percent, it takes 100 percent gain to get back to even, and, 2) while "low" interest gains look unimpressive at first glance, the simple act of avoiding losing years means that, in the end of the 12-year cycle, the conservative strategy outperforms the aggressive one by a long shot, since the principal has continually compounded without dramatic fluctuation. (And do I have to mention that you sleep better while not on the roller coaster?!)

The hare, every year, despite dramatic fluctuation, maintains the same average return as the tortoise. How is it possible to account for such different performance when the average return is 4 percent in both examples? Here is what investors often forget. Every time you lose money, you have eroded your principal, thus lessening the power of compounding, which Albert Einstein called the 8th wonder of the world. Unfortunately the majority of investors misunderstand this.

Which return stream would you rather have at the end of 12 years?

True or false: If I spent enough time at it, I could perform as well as most money managers so I will do it myself. Anyone with a little guts, perseverance and training can do this as well as a professional money manager.

FALSE. This one is especially tough to swallow. There is no shortage of lecturers, business books, videos, blogs, and other "educational" materials that promise you mastery; perhaps even the power to become a millionaire! The part-time investor is always at a disadvantage. Did Warren Buffet learn how to make investments from buying a CD-set online? Of course not, yet, our culture encourages an I-can-do-anything mindset; we hold sacred the idea that with a little effort and some knowledge, we can achieve our desires. We might dream of becoming Peyton Manning, yet for most of us, no matter how many footballs we throw, or how much time we spend throwing them, our experiences on the football field will no more threaten Mr. Manning's livelihood than reading WebMD all day threatens our doctor's job.

Misinformation is rampant; in the general and financial media, in the conversations we have with our friends and colleagues, and in our educational system. Caveat emptor never seems to apply since "services" rather than "goods" are being purchased. Often investors do not actively question the qualifications and experience of those who wish to sell them financial products since many do not know to ask about fiduciary obligations and responsibility.

In finance, once news is shared it becomes common knowledge rather quickly, and, is priced into the asset almost instantly. "Old news" is dramatically less valuable with regard to investment decisions. But, that does not stop those who stubbornly go along insisting that their way is best and they're able to manage their money better than anybody else. Now, with the plethora of financial professionals out there, many of whom are actually not money managers at all, it's definitely wise to proceed with caution.

If you have accumulated more than $1 million or more in investable assets, we recommend working exclusively with money managers who can provide audited results which are verified by an independent auditing firm. We further encourage you to seek clarity concerning who is managing your wealth. One great litmus test we recommend to our clients is to have everyone involved with managing their financial lives sign a fiduciary oath. If someone refuses to sign, it may be a clear indication that your interests are not being put first -- and the company's are.

The information contained in this article is provided solely for convenience purposes only and all users thereof should be guided accordingly. The Abernathy Group II does not hold itself out as a legal or tax adviser. If you wish to receive a legal opinion or tax advice on the matter(s) in this report please contact our offices and we will refer you to an appropriate legal practitioner.