Long term care insurance has gotten a bad reputation because insurers have been raising premiums on existing policies. The insurance companies admit they made a mistake - pricing policies too low and being surprised that there was so much usage of the benefits, and that so few people ever cancelled those policies (unlike life insurance policies).

As a result, people who bought long term care insurance have seen a premium increase of as much as 90 percent! The industry said it had to increase prices to be able to make good on its promises. That has been a bitter pill for those who had expected stable premiums and are now retired. Some have opted to decrease the coverage or the inflation protection. Most understand the importance of having at least some coverage for the cost of custodial care.

Here's the Savage Truth: Long term custodial care is hugely expensive. And the cost is not covered by Medicare or supplement policies. Only if you're truly impoverished, you can turn to your state Medicaid program for coverage - but it is unlikely to offer home care. Instead, you'll be stuck in a nursing home that is dependent on state Medicaid payments. That won't be your desired choice for care for yourself - or for your parents in your old age.

But now there are two new and fast-growing types of LTC insurance - products that ensure not only price stability, but a real return on your money - a death benefit -- in case you die without needing to use the long term care insurance.

Single Premium Combo LTC

This attractive deal offers a combination of life insurance, long term care insurance, and the ability to borrow cash out of the policy if you need the money for living expenses. These policies are perfect for those who have the ability to take a lump sum of money, probably currently sitting in CDs, to buy this policy. Putting the money into this combo product leverages the investment to provide far more in death benefits or long term care insurance than they would have if they just kept their money in traditional investments.

Two major companies (OneAmerica and Lincoln National) offer it currently, but many others are racing to create products. The products are sold through independent brokers that specialize in LTC policies, such as MagaLTC.

OneAmerica is the largest provider (www.OneAmerica.com) and gave me these examples:

For a woman age 55, who could afford to place $100,000 of her savings in this product, she would have $4400 per month lifetime long term care coverage. And if she did not need or use the care, the death benefit on the policy would be $220,000.

If she waits until age 65 to buy this policy, her $100,000 premium would buy $3260 per month of Lifetime LTC protection, and a death benefit of $163,000 if no care is utilized.

Once purchased, you don't have to worry about any premiums increasing. Your benefits are guaranteed. Yes, the cost of care might rise. But at least you have enough coverage to afford home care, or buy your way into assisted living, or a better quality nursing facility. And if you choose a shorter (5 years instead of lifetime) period of long term care coverage, you will get a higher benefit each month.

Okay, I know what you're thinking: a $100,000 deposit into a life/LTC insurance policy is a bit steep! But that's where the second creative solution comes in - a solution that also takes away the worry of rising LTC insurance premiums in the future, when you can least afford them.

Annual Funding Life/LTC Insurance

This combo type policy, often called "asset-based" is such a good idea that the insurers have created ways to make it more widely available. Instead of depositing a lump sum, all at once, you can now make the cash deposit into the policy in a fixed amount over a period of years.

It's called "annual funding." And, of course, the cash value for the insurance care doesn't build up quite as fast - but that's not a problem if you're in your 40s and don't expect to need the care for at least 20 years. Best of all, this annual premium is guaranteed never to increase - even if you choose lifetime long term care protection.

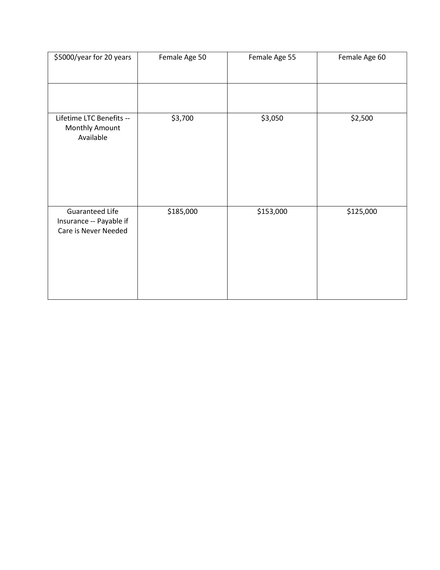

So instead of making a deposit of $100,000 into this policy, let's see what happens if you pay in $5,000 per year over 20 years.

In effect, you are buying similar coverage - over time - with a guaranteed flat premium. And, quite obviously, the leverage of your invested dollars is greater the younger you make the purchase. Also note that the coverage for long term care is for your lifetime, which takes away the concern about outliving your LTC coverage. Remember, the policy is completely paid up after 20 years - guaranteed.

And, as another benefit, if you really needed cash, you could borrow from the money you have in the policy - reducing your death benefit and long term care coverage. Also, this coverage is available for two people on one policy (typically spouses), which makes the pot even larger for both life and LTC coverage. The LTC protection can be accessed by either or both insureds for their combined lifetimes.

Getting older is far better than the alternative. But taking care of our parents - or having children take care of us - in our old age is an expensive burden to place on each generation. That's something to think about as Mother's Day and Father's Day approach. Long term care insurance - either a traditional policy or one of these asset-based policies - can make a huge difference in a family's finances. And that's The Savage Truth.